34+ How to borrow the maximum mortgage

544 464 comparison rate. We performed a rigorous statistical analysis on our trading system.

Bwsoeu 8pgnfjm

APR Certificate of Deposit 6.

. Maximum loan amount is 15000000. 534 499 comparison rate Average 5-year fixed rate. Maximum LTV 70 with a maximum loan amount of 150000.

Note that your monthly mortgage payments. You can give up to a certain amount per person each year without paying taxes. Copy and paste this code into your website.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. A home loan or mortgage is a loan from a bank or other financial institution to buy build.

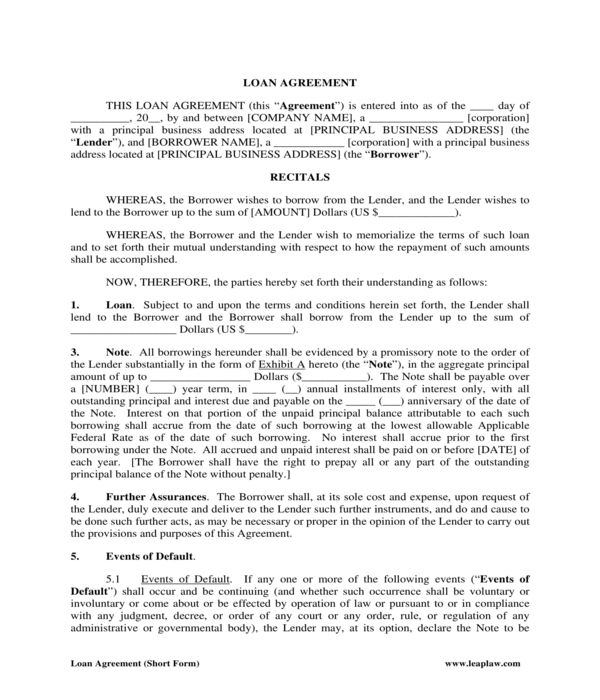

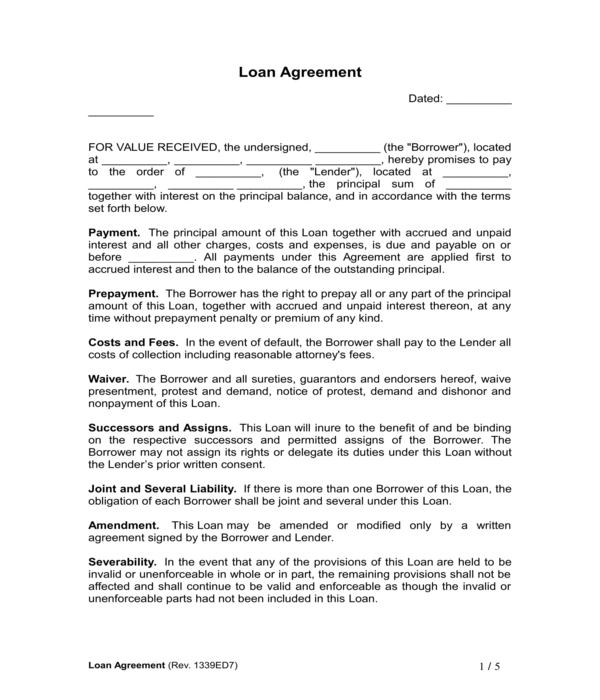

Look at different family mortgage loan agreements for reference. Some states also set statutory maximum amounts on the interest that you can. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Qualified members can finance 80 loan to value less outstanding mortgage. After a partner or spouse or parent dies so does their annual income so a life insurance policy can help fill in the gaps to pay financial obligations such as. LVR subject to HSBCs assessment lending criteria and Lenders Mortgage Insurance LMI acceptance.

Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase. Rental price 70 per night. Prime 2 to Prime 4 APR.

The organizations primary goals are to provide mortgage liquidity assist in affordable housing. Adjustment could occur after initial term. Loan agreement 13 11 KB family loan agreement 14 99 KB family loan agreement 15 17 KB family loan agreement 16 34 KB family loan agreement 17 63 KB family loan agreement 18 290 KB.

Below are the results of these tests. Non-owner occupied Fixed Home Equity Loans. With a capital and interest option you pay off the loan as well as the interest on it.

Daily Treasury PAR Yield Curve Rates This par yield curve which relates the par yield on a security to its time to maturity is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. Maximum adjustment over the life of the loan is 6. Calculate how much you can borrow Calculate how much you can borrow View Home Loan Borrowing.

At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month while a 15-year term might cost a month. A first position loan is available only if there is no outstanding mortgage balance or other first-lien obligation. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Second mortgage types Lump sum. Maximum additional loan term is 25 years if any element of your mortgage is on interest only. It was originally established after World War II to help returning war veterans find housing.

A fixed-rate mortgage means your monthly principal and interest payments will stay the same for the life of your loan. That amount is the annual exclusion amount which is 16000 in 2022 15000 for 2021. Residential - Maximum 60 Loan to Value - Maximum Loan Amount 5000000 Product Initial interest rate Initial interest rate period Followed by a Variable Rate currently Booking fee Overall cost for comparison APR 2 Year Tracker Standard.

The total amount payable would be 3179014 mortgage including a 2499 product fee plus 1226017 interest and a 225 account fee. Qualified members can finance 90 loan to value less outstanding mortgage. A longer-term loan allows for lower monthly payments.

Maximum annual adjustment is 2. Lenders may also refer to this as a maximum loan-to-value ratio LVR of 80. For 81 to 90 of appraised value borrow up to 50000 maximum for Home Equity loans and Home Equity Lines of Credit.

Non-owner occupied HELOC rates. You can purchase tax liens. Published rate may be adjusted based on credit score and down payment.

Credit provided by HSBC Bank Australia Limited ABN 48 006 434. Single Family SRF FNMA warrantable Condo. The par yields are derived from input market prices.

Maximum loan amount is 100000 4 Maximum LTV loan to value. See Developer Notice on February 2022 changes to XML data feeds. Canada Mortgage and Housing Corporation CMHC is a Crown Corporation of the Government of Canada.

How the Gift Tax Works. 59 payments of 9842 with a final payment of 9828. With an interest only mortgage you are not actually paying off any of the loan.

Purchase 51 ARM requires 3 down payment cash out refinance 51 ARM requires 5 equity. Latest news on economy inflation micro economy macro economy government policy government spending fiscal deficit trade trade agreement tax policy indian. At the end of the mortgage term the original loan will still need to be paid back.

Maximum LTV 70 with a maximum loan amount of 150000. Adjustment is based on 1-year CMT plus margin of 275. Monthly payments on a 200000 mortgage.

Available on new borrowings from 50000. The mortgage should be fully paid off by the end of the full mortgage term. It has since expanded its mandate to improve Canadians access to housing.

Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage. The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to. 638 Lowest 5-year rate.

Learn about 2022s Jumbo reverse mortgage loans including real-time lenders rates closing costs and loan eligibility. We do not offer additional loans above a maximum LTV of 85 including your existing mortgage. 2 Year Tracker Premier Standard.

The ability to borrow on a non-FHA-approved condo unit. We bootstrapped 1000 instances using 20 30 and 40 random stocks from the SP 500 list and calculated maximum drawdown from inception 1990. For loans up to 100000.

Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. You could buy a rental property use your IRA as a bank and loan money to someone backed by real estate ie a mortgage.

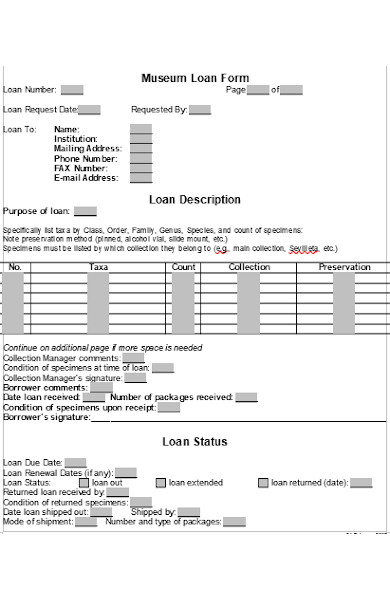

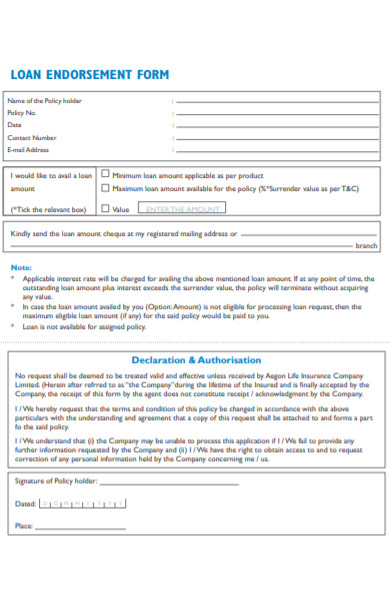

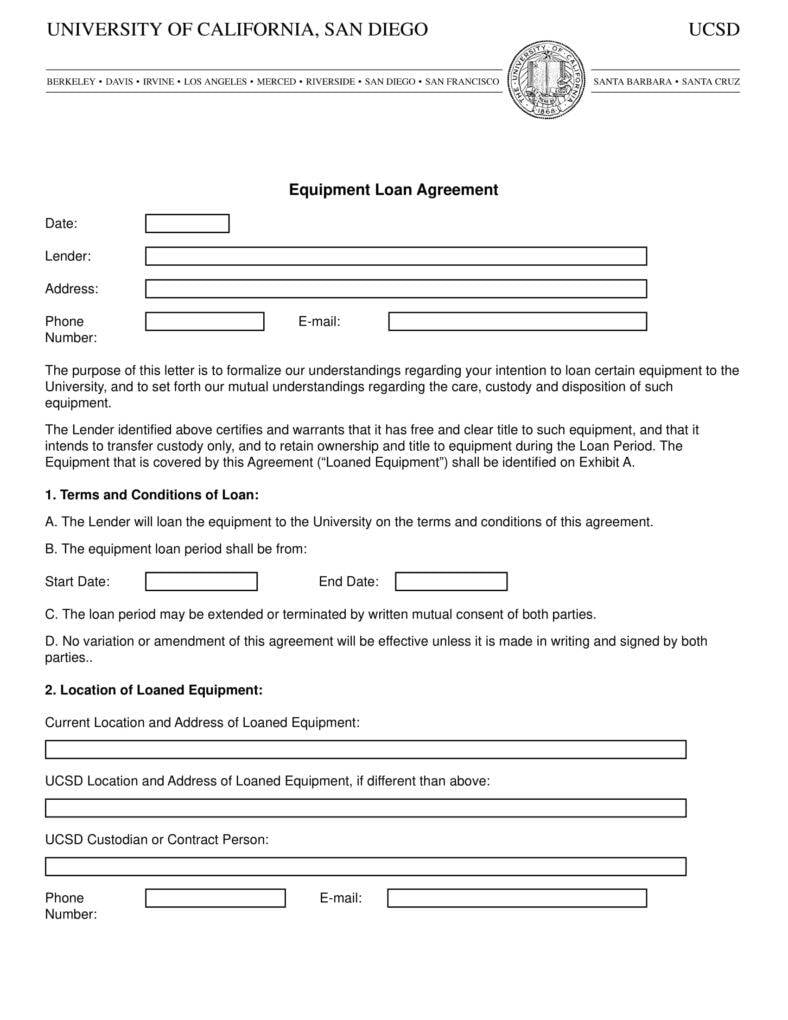

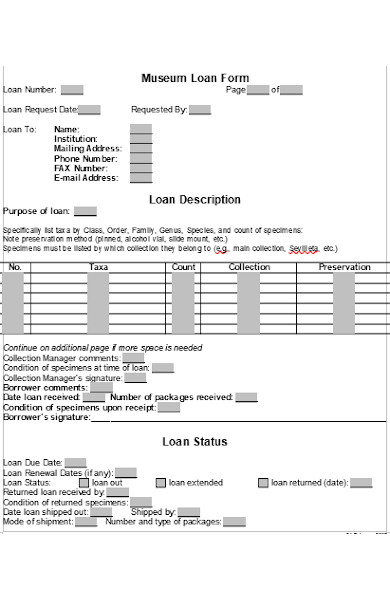

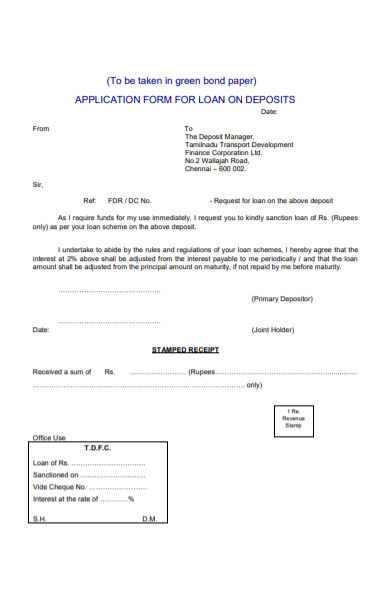

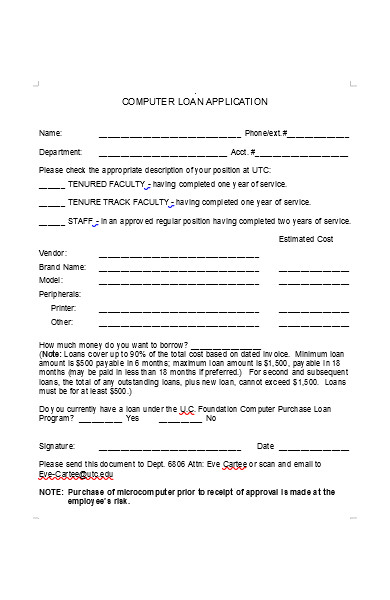

Free 55 Loan Forms In Pdf Ms Word Excel

Free 55 Loan Forms In Pdf Ms Word Excel

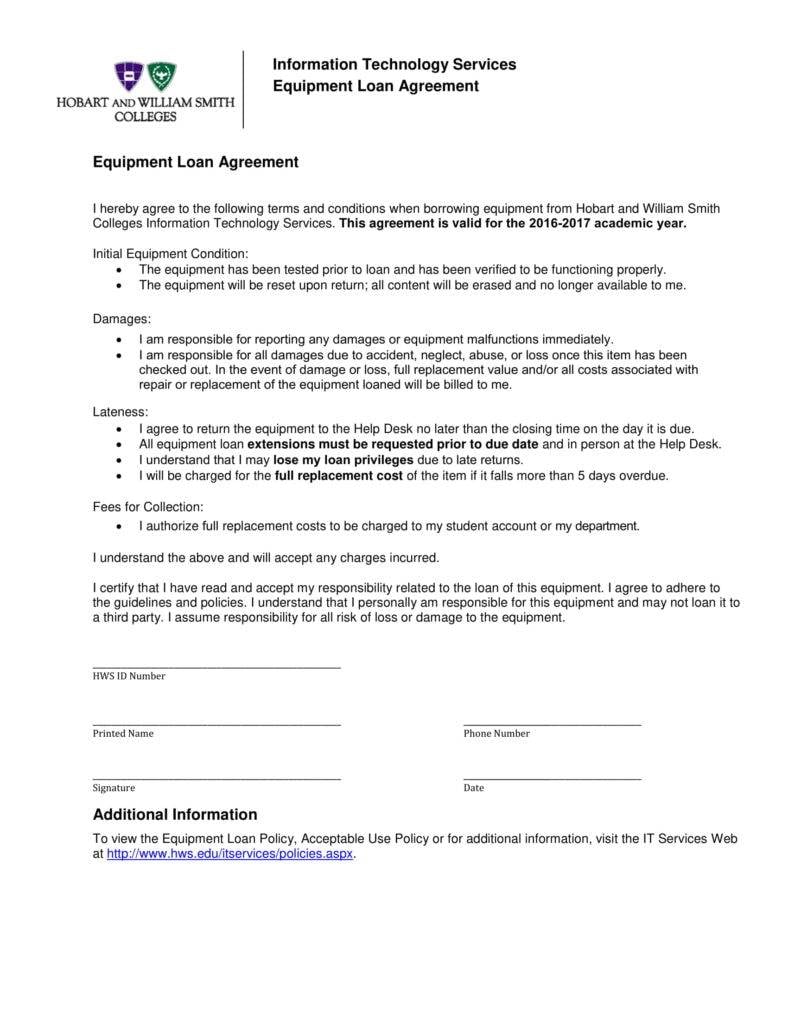

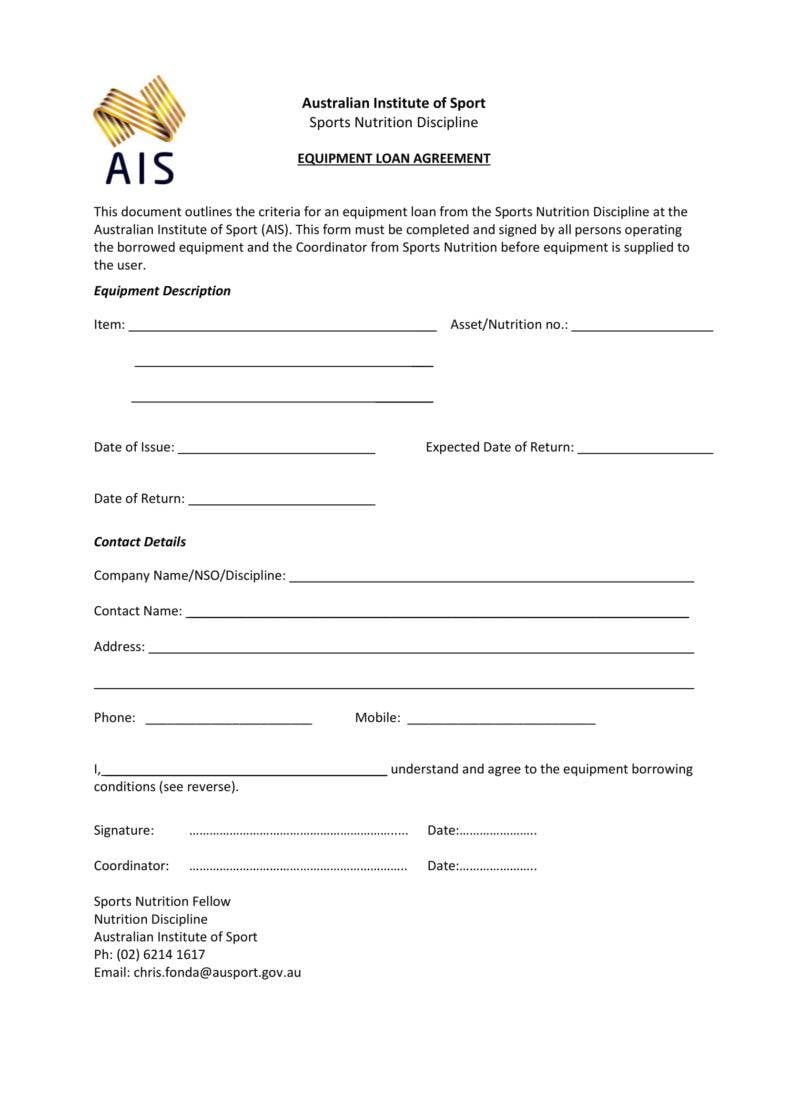

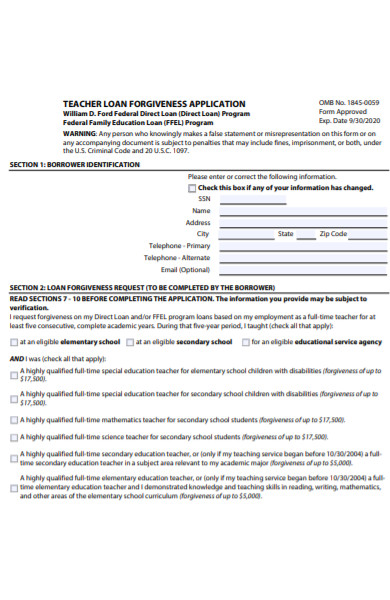

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

Pros And Cons Of Fha 203k Loan Free Business Card Design Fha 203k Loan Business Card Design

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

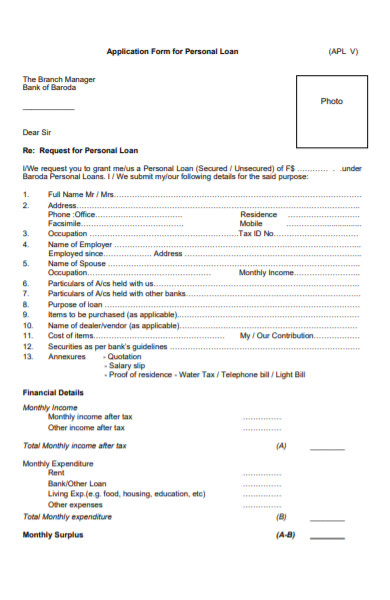

Free 5 Personal Loan Agreement Forms In Ms Word Pdf

Free 55 Loan Forms In Pdf Ms Word Excel

Coinloan Crypto Exchange August 2022 What To Know Finder Com

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loa Usda Loan Mortgage Loans Home Loans

Loan App Project Mobile Web Design Loan App

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Free 55 Loan Forms In Pdf Ms Word Excel

Free 55 Loan Forms In Pdf Ms Word Excel

Free 5 Personal Loan Agreement Forms In Ms Word Pdf

Free 5 Personal Loan Agreement Forms In Ms Word Pdf

Free 55 Loan Forms In Pdf Ms Word Excel